Simplify Tax Computation with the GST Calculator

As a business owner, one of the most important tasks you need to do is calculate your taxes accurately. However, this can be a daunting task, especially if you are new to the world of taxation. This is where the GST calculator comes in. The Goods and Services Tax (GST) calculator is a tool that helps you calculate the GST payable for your business. It simplifies tax computation and reduces the risk of errors in your tax filings.

What is the GST Calculator?

The GST calculator is an online tool that computes the GST payable for your business transactions. It is designed to help businesses and taxpayers calculate the GST they need to pay on their sales invoices, purchase invoices, and other transactions. The calculator takes into account the GST rates for different types of goods and services and the input tax credit available to businesses.

Features of a GST Calculator

A GST calculator is a simple and user-friendly tool that anyone can use. The key features of a GST calculator are:

1. Easy to use:

The GST calculator is easy to use and does not require any special skills or knowledge.

2. Accurate:

The calculator is accurate and reliable, so you can be sure that your tax calculations are correct.

3. Time-saving:

The GST calculator saves time by automating the calculation process, so you can focus on other important tasks.

4. Cost-effective:

The GST calculator is a cost-effective way to calculate your taxes since it is a free tool.

How to Use the GST Calculator?

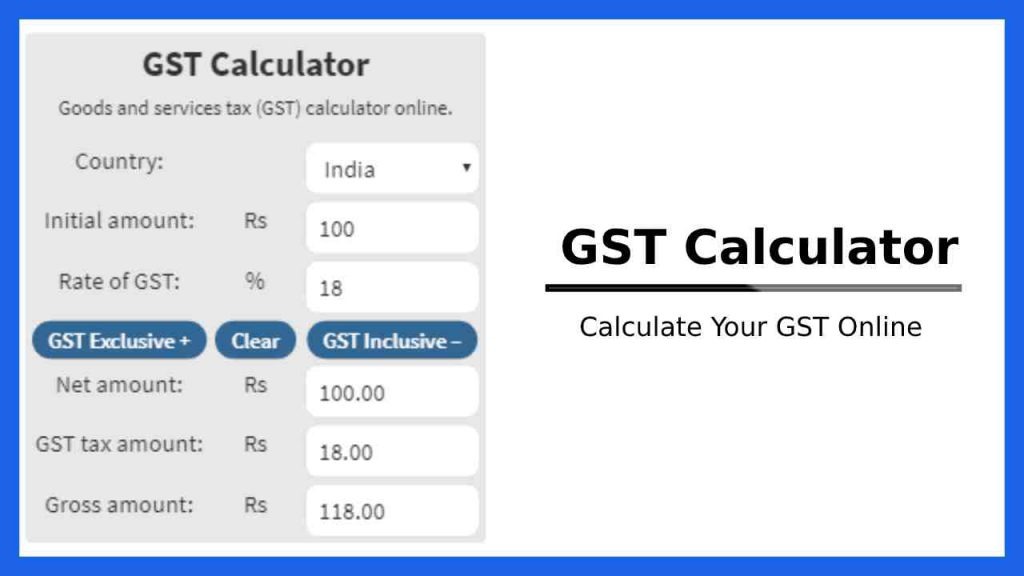

Using the GST calculator is simple and straightforward. The following steps will guide you on how to use the calculator:

- Enter the sales or purchase amount: In the first field, enter the amount of the sales or purchase transaction.

- Select the GST rate: In the second field, select the GST rate applicable to the transaction. The GST rates are 0%, 5%, 12%, 18%, and 28%.

- Click on Calculate: After selecting the GST rate, click on the Calculator button to get the GST amount.

- Output: Once you click on the Calculator button, the GST amount will be displayed on the screen, along with the total amount, including GST.

Benefits of Using a GST Calculator

The GST calculator offers several benefits to businesses and taxpayers. Some of the key benefits include:

1. Accurate Tax Calculations:

The GST calculator ensures accurate tax calculations, which can help to avoid penalties for incorrect filings.

2. Time-Saving:

Calculating taxes manually can be time-consuming. The GST calculator saves time by automating the computation process, freeing up time for other business activities.

3. Cost-Effective:

The GST calculator is a free tool, which makes it a cost-effective way to calculate your taxes.

4. Helps with Budgeting:

By accurately calculating taxes, businesses can budget better and manage their finances effectively.

5. Reduces Errors:

The GST calculator reduces the risk of errors in tax filings, which can lead to penalties and fines.

GST and Business Loans

The GST is a crucial factor when it comes to getting a business loan. Most lenders take the GST into account when evaluating loan applications. The GST needs to be factored into your business cash flow projections and financial statements. If you apply for a loan without taking into consideration the GST, the lender may reject your application.

To ensure that your loan application is successful, you need to have a clear understanding of your business income and expenses, including the GST. Using a GST calculator can help you accurately calculate your taxes, ensuring that your financial statements and cash flow projections are accurate.